India

Societe Generale India Branch

National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement (RTGS)

Societe Generale India is live with NEFT and RTGS 24x7 Facility. This service can be aviled through Global Cash, Societe Generale's E-banking platform. Please refer to the terms and conditions for more details.

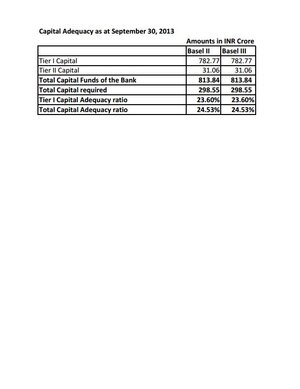

Capital Adequacy Disclosures

Basel III Disclosures 31 December 2024

Basel III Disclosures 30 September 2024

Basel III Disclosures 30 June 2024

Basel III Disclosures 31 March 2024

Basel III Disclosures 31 December 2023

Basel III Disclosures 30 September 2023

Basel III Disclosures 30 June 2023

Basel III Disclosures 31 December 2022

Basel III Disclosures 30 September 2022

Basel III Disclosures 30 June 2022

Basel III Disclosures 30 September 2024

Basel III Disclosures 30 June 2024

Basel III Disclosures 31 March 2024

Basel III Disclosures 31 December 2023

Basel III Disclosures 30 September 2023

Basel III Disclosures 30 June 2023

Basel III Disclosures 31 December 2022

Basel III Disclosures 30 September 2022

Basel III Disclosures 30 June 2022

Archives [+-]

- Basel 3 Disclosures 31 March 2022

- Basel III Disclosures 31 December 2021

- Basel III Disclosures 30 September 2021

- Basel III Disclosures 30 June 2021

- Pillar III disclosures Mar 2021 FINAL

- Basel III Disclosures 31 December 2020

- Basel III Disclosures 30 September 2020

- Basel III Disclosures 30th June 2020

- Pillar 3 Disclosures 31st March 2020

- Basel 3 Disclosures 31st December 2019

- Basel 3 Disclosures 30th September 2019

- Basel 3 Disclosures 30th June 2019

- Pillar 3 Disclosures 31st March 2019

- Basel 3 Disclosures 31st December 2018

- Basel 3 Disclosures 30th September 2018

- Basel 3 Disclosures 30th June 2018

- Basel 3 Disclosures 31st December 2017

- Basel III Disclosures 30 September 2017

- Basel 3 Disclosures 30th June 2017

- Basel 3 Disclosures 31st March 2017

- Basel 3 Disclosures – 31st March 2016

- Pillar 3 Disclosures – 31st December 2016

- Pillar 3 Disclosures – 30th September 2016

- Pillar 3 Disclosures – 30th June 2016

- Pillar III Disclosures 31st March 2014

- Pillar III Disclosures 30th September 2014

- Pillar III Disclosures 31st December 2014

- Pillar III disclosures 31st March 2015

- Pillar III Disclosures 30th June 2014

- Pillar III Disclosures 30th Sept 2013

Financial Annual Reports

Financial statement for the year ended March 31 2024

Financial statement for the year ended March 31 2023

Financial statement for the year ended March 31 2022

Financial statement for the year ended March 31 2023

Financial statement for the year ended March 31 2022

Archives [+-]

- AUDIT REPORT 2021 22

- Financial statement for the year ended March 31 2021

- Financial statement for the year ended March 31 2020

- Financial statement for the year ended March 31 2019

- Financial Statement for the year ended March 31 2018

- Financial Statement for the year ended March 31 2017

- Financial Statement for the year ended March 31 2010

- Basel 2 disclosures of the Indian branches for the year ended March 31 2010

- Basel 2 disclosures of the Indian branches for the year ended March 31 2011

- ANNUAL REPORT 2015 16

- Financial Statement for the Year ended March 31 2015

- Financial Statement for the Year ended March 31 2014

- Financial Statement for the Year ended March 31 2013

- Financial Statement for the year ended March 31 2012

- Financial Statement for the year ended March 31 2011

Policies

Policy on Appointment and Re appointment of Statutory Auditors

CSR Policy

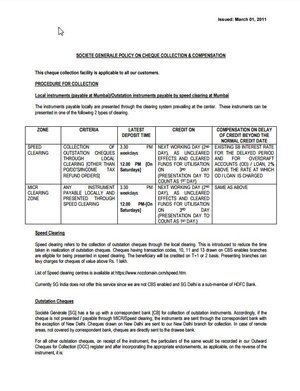

Customer Compensation Policy 01

Customer Compensation Policy

Policy on Protected Disclosure Scheme

Deposit Policy

SG India Customer Grievance Redressal Policy

Guidelines on Fair Practices Code for Lenders

Policy on Collection of Dues and Re possession of Security

CSR Policy

Customer Compensation Policy 01

Customer Compensation Policy

Policy on Protected Disclosure Scheme

Deposit Policy

SG India Customer Grievance Redressal Policy

Guidelines on Fair Practices Code for Lenders

Policy on Collection of Dues and Re possession of Security

Information

Claim Procedure Unclaimed Deposits

RBI Integrated Ombudsman Scheme English version

RBI Integrated Ombudsman Scheme Hindi version

RBI Financial Awareness Campaign

Central KYC Registry

Notice – System Upgrade on 10 April 2023

Frauds and Cybercrimes Modus Operandi

Comprehensive Notice Board Jan 31st 2023

Banking Ombudsman Scheme Details Form Statistics March 31st 2022

Complaint Form

General Security Tips

Societe Generale India Citizen s Charter Sep 2017

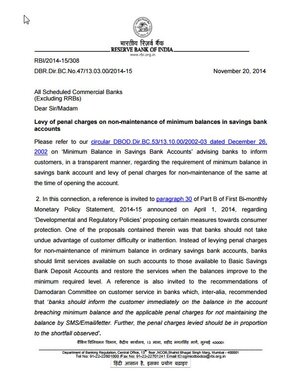

RBI Circular on levy of penal charges on non maintenance of minimum balances

RBI Circular on Cheap Money Offers etc

Banking Ombudsman Scheme 2006

RBI Integrated Ombudsman Scheme English version

RBI Integrated Ombudsman Scheme Hindi version

RBI Financial Awareness Campaign

Central KYC Registry

Notice – System Upgrade on 10 April 2023

Frauds and Cybercrimes Modus Operandi

Comprehensive Notice Board Jan 31st 2023

Banking Ombudsman Scheme Details Form Statistics March 31st 2022

Complaint Form

General Security Tips

Societe Generale India Citizen s Charter Sep 2017

RBI Circular on levy of penal charges on non maintenance of minimum balances

RBI Circular on Cheap Money Offers etc

Banking Ombudsman Scheme 2006

Information by Regulator

Pursuant to applicable Reserve Bank of India directions and our communications in this regard from time to time, we encourage all our clients to obtain LEI codes. We would like to reiterate that it will be mandatory to include remitter and beneficiary LEI information while initiating RTGS and NEFT transaction of 50 Crore and above.

Security awareness

Rates & Charges

Societe Generale is a member of Banking Codes and Standards Board of India.

For all loans and deposits Societe Generale will follow day count based on 365 days to calculate the interest.