The new narrative of ESG investing

By Amy Zhang, Head of Sustainable Solutions and Products for Asia Pacific at Societe Generale

Since the boom in 2020, global Exchange Traded Fund (ETF) investments that embed ESG criteria have gone through some bumpy years – particularly in 2023. Macroeconomic events such as the energy price shock in Europe, interest rate hikes, and even political elections, have had a profound impact on ESG investing.

While it is true that ESG investing is becoming more nuanced, we do not think it is going away. There are three main reasons why we expect it will continue to deliver long-term value:

- Definitions matter: narrow interpretations of ESG principles are what lead to different views of investment performance, not the principles themselves.

- ESG, and decarbonisation in particular, will remain a long-term theme, and embedding ESG does not necessarily mean sacrificing performance.

- Regulatory expectations of ESG are increasing in the areas of investment risk management and disclosure. But global investors are still seeking opportunities in spite of the headwinds.

Investors need to be mindful of the over-concentration risks and unwanted bias when applying their ESG rules. Better research and forward-looking data, as well as an in-depth understanding of ESG topics and the market, can help address such concerns and enable better decision-making.

A tough test in 2023

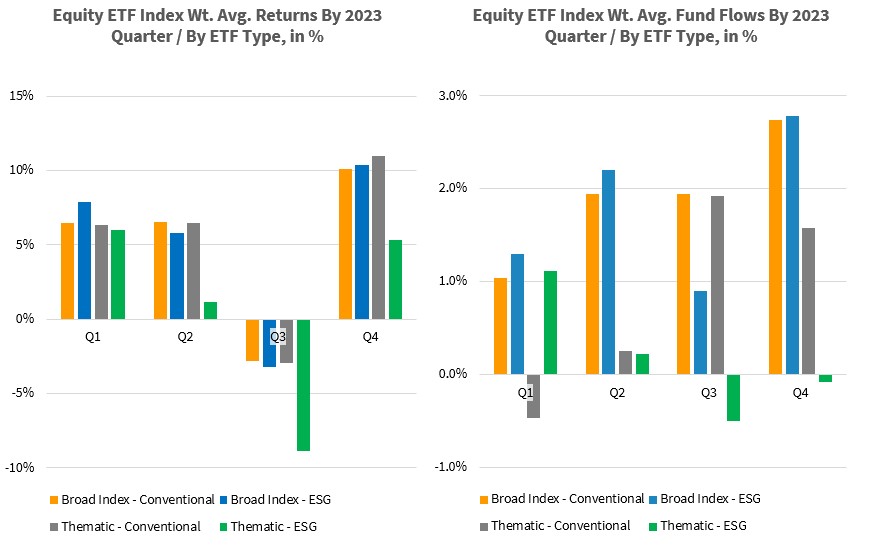

Analysis by Societe Generale’s Global Markets ESG advisory experts shows that thematic ESG equity ETFs1 underperformed both their conventional2 and broad ESG counterparts3 – despite an improvement in performance in the fourth quarter of 2023 (chart 1, left).

This is partly explained by a slump in the performance of renewables, such as solar and wind. There were a number of factors behind this, including the collapse of margins due to rising costs. At the same time, rising interest rates hurt balance sheets. And all this has added to familiar challenges like overcapacity.

The performance of broad ESG equity ETFs for the period is nearly on a par with that of broad conventional ones. Thematic ESG equity ETFs suffered most from outflows over the period, in sharp contrast to those with a broad ESG approach, as well as a conventional approach4 (chart 1, right).

Chart 1

Source: Bloomberg, SG Global Markets ESG Advisory analysis, based on the data available as of December 2023.

ESG indices and ETFs are identified using either(a) a list of keywords used in their names (defined by Societe Generale), (b) Bloomberg General Attribute data field, or (c) SFDR Article 8 or Article 9 classification. ESG ETFs are also categorised as either “Broad - ESG”, i.e., their composition is constructed using broad indices as their starting universe, or as “Thematic - ESG”, i.e., the composition is based upon a specific thematic, and can therefore deviate significantly from broad indices. Details are available upon request.

The value of your investment may fluctuate. The figures relating to past performances and/or simulated past performances refer or relate to past periods and are not a reliable indicator of future results. This also applies to historical market data.

ESG investing is here to stay

Despite a challenging 2023 for thematic ESG equity ETFs, some investors see the underperformance of renewable energy as a fresh opportunity for undervalued stocks. Many think the potential of renewable technologies is yet to be fully priced in. Geopolitics-driven decoupling, reshoring or friend-shoring may accelerate the growth of a clean energy value chain.

In our view, the confusion around the definition of ‘ESG investments’ complicates any meaningful comparison with conventional investments. As cited in the Financial Times, the following comment from Ian Simm, founder of Impax Asset Management and a board member of the Institutional Investors Group on Climate Change, sums up the challenge:

“The acronym ESG is a bit of a confused compact because it muddies at least two things. One is an objective assessment, around risk and opportunity. And the other is around values or ethics.” 5

While the Global Sustainable Investment Alliance has published harmonised definitions of investment approaches, definitions of what comprises ‘ESG investment’ are not always standardised, leading to different conclusions of how ESG has fared compared to the broad market.

Also, as has been noted by our research team, perceived underperformance of ESG funds is not a reason to blame ESG principles themselves. Rather, it is often the narrow interpretation of these principles that has caused mismatches in understanding and expectations6.

Investors should apply caution to exclusionary screening and over-concentration on certain sectors (notably renewables, such as solar and wind). More in-depth research, data, and forward-looking assessment frameworks that focus on financially material ESG issues should help investors mitigate unwanted risks from any bias to small and mid-cap companies.

Secondly, embedding ESG does not have to mean sacrificing returns. But change takes time; ESG investing will most probably benefit investors who embrace the time needed for good practices and climate solutions.

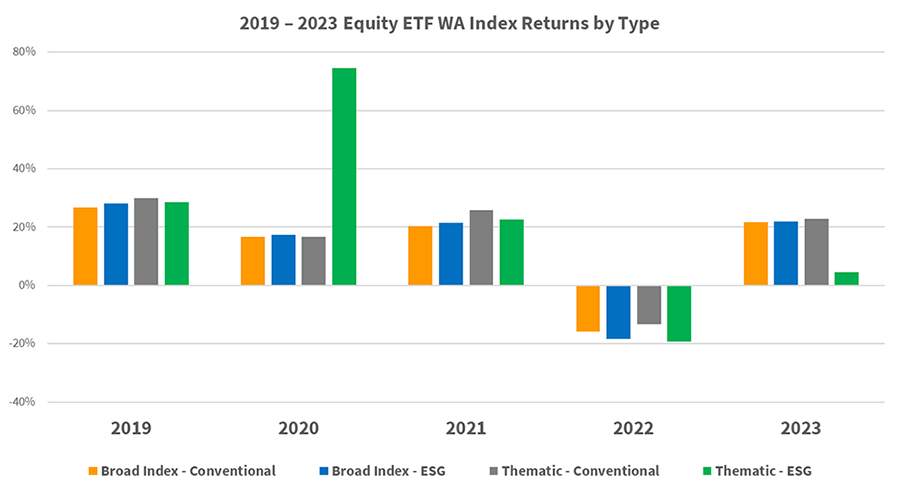

The precise timeframe matters too. It is possible for broad ESG strategies to deliver a similar performance to conventional strategies. This is seen not only in equity ETFs over the period of 2019 to 2023 (chart 2), but also when looking at equity and fixed-income ETFs in the first quarter of 2024 (chart 3). Despite a weaker inflow for broad ESG equity ETFs, weighted average returns were similar, with a difference of just 0.65%. In the case of fixed-income, broad ESG ETFs attracted more flows than conventional, but with a similar weighted average return.

Chart 2

Source: Bloomberg, SG Global Markets ESG Advisory analysis, based on the data available as of 31 December 2023.

ESG indices and ETFs are identified using either(a) a list of keywords used in their names (defined by Societe Generale), (b) Bloomberg General Attribute data field, or (c) SFDR Article 8 or Article 9 classification. ESG ETFs are also categorised as either “Broad - ESG”, i.e., their composition is constructed using broad indices as their starting universe, or as “Thematic - ESG”, i.e., the composition is based upon a specific thematic, and can therefore deviate significantly from broad indices. Details are available upon request.

The value of your investment may fluctuate. The figures relating to past performances and/or simulated past performances refer or relate to past periods and are not a reliable indicator of future results. This also applies to historical market data.

Chart 3

Source: SG Global Markets ESG Advisory analysis, Bloomberg, as of 31 March 2024. The analyses are based upon a universe of worldwide ETFs, with Asset Class Focus of Equity and Fixed Income respectively. ESG indices and ETFs are identified using either(a) a list of keywords used in their names (defined by Societe Generale), (b) Bloomberg General Attribute data field, or (c) SFDR Article 8 or Article 9 classification. ESG ETFs are also categorised as either “Broad Index - ESG”, i.e., their composition is constructed using broad indices as their starting universe, or as “Thematic Index - ESG”, i.e., the composition is based upon a specific thematic, and can therefore deviate significantly from broad indices. Details are available upon request.

Index returns are based upon the net total return (when available) between 31 December 2023 and 31 March 2024.

The value of your investment may fluctuate. The figures relating to past performances and/or simulated past performances refer or relate to past periods and are not a reliable indicator of future results. This also applies to historical market data.

Thirdly, there has been an increase in global regulatory expectations to incorporate ESG – particularly climate and other environmental considerations – in investment risk management and disclosures. Certain recent regulatory publications7 have introduced frameworks that could lead to restrictions on the investment universe for ESG funds8. Such frameworks can help lower investment risk by diverting capital towards those issuers with lower ESG or climate transition risks.

Investors who see value in ESG investing are still navigating the headwinds for opportunities.9 Heightened scrutiny of sustainability claims is also making the ways in which ESG is defined, implemented, and communicated more important than ever. Not ‘doing ESG’ or not disclosing properly how it is applied risk damaging the reputation of a company or a fund10 11 12, including in Asia-Pacific – a topic that has been monitored over time by Societe Generale experts.13

All in all, we believe that the concept of ESG is here to stay. It might be called different things, but the essence of the three letters remains in how a company deals with its people, its stakeholders along the value chain, and more broadly with the community and the environment.

Investors should make sure that their definition of ‘ESG investment’ precisely aligns with their philosophy and is communicated accurately. In-depth research, coupled with data-driven insights, can also help them identify risks, navigate evolving ESG developments and articulate what real-world impact they are making through their investments.

1. ETFs and the indexes they track with thematic focuses related to ESG (e.g., clear energy, clean water).

2. Traditional equity ETFs with no ESG factors embedded; these include two strategies: 'Conventional – Broad’ (using broad indices as their starting universe) and ‘Conventional – Thematic’ (the composition is based upon a specific thematic and can therefore deviate significantly from broad indices). ‘ESG’ ETFs (or indexes they track) are identified using either(a) a list of keywords used in their names (defined by Societe Generale Global Markets ESG Advisory Team), (b) Bloomberg General Attribute data field, or (c) the Sustainable Finance Disclosure Regulation (SFDR) Article 8 or Article 9 classification.

3. ESG ETFs with a broad screening approach (e.g., negative screening only, screening based on ESG rating or low carbon.

4. For ETFs of both ‘Broad – Conventional’ and ‘Thematic – Conventional’ strategies.

5. How ESG investing came to a reckoning, Financial Times, 6 June 2022

6. doc.sgmarkets.com/en/3/0/156901/315825.html

7. For example, the Final Report - Guidelines on Funds’ Names Using ESG or Sustainability-related Terms from the European Securities and Markets Authority.

8. Defined by funds with relevant wording in the name.

9. www.ft.com/content/286fe73e-d12f-47bc-b2a4-0e5c6c5c334c

10. asic.gov.au/about-asic/news-centre/find-a-media-release/2024-releases/24-061mr-asic-wins-first-greenwashing-civil-penalty-action-against-vanguard/

11. www.sec.gov/newsroom/press-releases/2022-86

12. www.reuters.com/legal/dws-pay-25-mln-over-us-charges-over-esg-misstatements-other-violations-2023-09-25/

13. www.societegenerale.asia/en/newsroom/press-releases/press-releases-details/news/greenwashing-green-enabling/

日本のエネルギー・トランジションに向けて「東」と「西」を結ぶ

昨年ソシエテ・ジェネラルがグローバルロードショーの一環として開催した「ポジティブ・インパクト・デー」の東京会場では、日本の脱炭素化政策と国際的なパートナーとしての役割について、最新の動向を踏まえた活発な議論がなされました。

2024年第4四半期および2024年通期決算

パリ、2025年2月6日